As the Executive Director of International Studies Foundation (ISF), a significant aspect of my daily responsibilities involves securing funding for the growth and development of our various projects. In my interactions with companies and individuals, I frequently encounter questions regarding the advantages of corporate donations to nonprofit organizations like ours.

It is becoming increasingly apparent that businesses can make a significant impact by supporting nonprofit organizations. By understanding the tax advantages and positive outcomes that such support can bring, both parties can work together to create lasting change.

In this article, I will discuss the tax benefits companies can experience by contributing to 501(c)(3) organizations like ISF, and how these donations foster a mutually beneficial situation for both the corporation and the nonprofit.

Tax-Deductible Donations: Tax-Deductible Donations: Donating to a 501(c)(3) organization enables companies to deduct the value of their contributions from their taxable income, up to 10% of the company’s taxable income for the year. This directly reduces the company’s tax liability, resulting in significant tax savings. However, there may be some exceptions to this general rule depending on the specific circumstances and nature of the donation.

Let’s say, for example, that your company, XYZ Corp, has a taxable income of $500,000 for the tax year. You’re considering making a cash donation to a 501(c)(3) organization and would like to understand the deduction limit and tax benefits.

As a corporation, XYZ Corp can deduct donations up to 10% of its taxable income, which in this case amounts to:

$500,000 (taxable income) x 10% (deduction limit) = $50,000

This means that if XYZ Corp donates $50,000 or less to the 501(c)(3) organization, the entire donation amount is tax-deductible. Any amount donated beyond the $50,000 limit will not be deductible in the current tax year but can be carried forward for up to five years.

Please note that exceptions may apply to certain donation types or non-501(c)(3) organizations. Rules can also vary based on a company’s tax structure and operations. Always consult a tax professional for accurate guidance on corporate donations.

Enhanced Corporate Reputation: A 2020 study by Cone Communications found that 86% of consumers are more likely to trust a company that supports social or environmental issues.

This shows that supporting a nonprofit organization not only benefits the community but also helps companies build a strong brand image and showcase their commitment to corporate social responsibility.

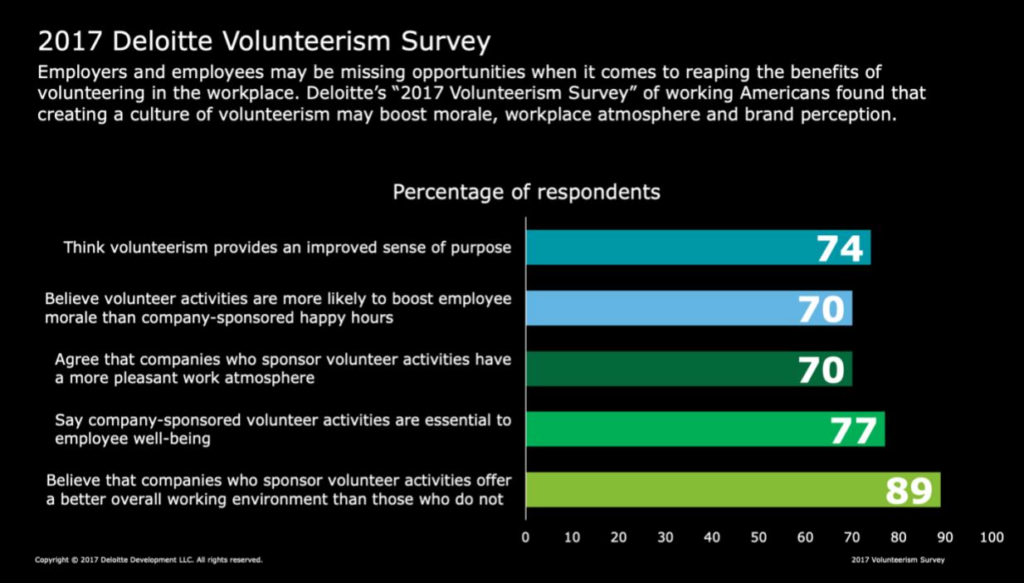

Employee Engagement: There is also evidence that encouraging employees to participate in charitable activities can lead to increased job satisfaction and improved teamwork, ultimately contributing to a positive work environment and higher retention rates (one of the biggest challenges companies are facing in 2023).

As a 2017 Deloitte Volunteer Impact Research study found; employees who participate in company-sponsored volunteer activities are more likely to be proud of their company, feel a stronger connection to their employer, and report higher job satisfaction rates.

Talent Retention: Corporate Social Responsibility (CSR) has become a critical factor in talent retention in 2023. A study by Cone Communications (2021) revealed that 76% of millennials consider a company’s CSR commitments when choosing where to work, while 64% would refuse a job if the company lacked strong CSR practices (Cone Communications, 2021). Generation Z, the newest cohort in the workforce, shares similar concerns for ethical business practices (PWC, 2021). Companies with well-developed CSR programs experience 57% higher employee engagement levels and a 50% lower turnover rate (Corporate Executive Board, 2021). Consequently, CSR initiatives in 2023 remain essential for companies aiming to retain top talent and stay competitive.

By understanding and leveraging these benefits, companies can make a real difference in their communities while also improving their bottom line.

Stay tuned for my next article, where I will dive deeper into the tax benefits of sponsoring nonprofit events and programs.

References:

· Cone Communications (2021). Cone Communications Millennial Employee Engagement Study.

· PWC (2021). Workforce of the Future: The Competing Forces Shaping 2030.

By Alfonso Barral, Executive Director of International Studies Foundation (ISF)